Swiggy or Zomato Which is Better: 10 FAQ Answered

Swiggy or Zomato Which is Better: A Detailed Overview

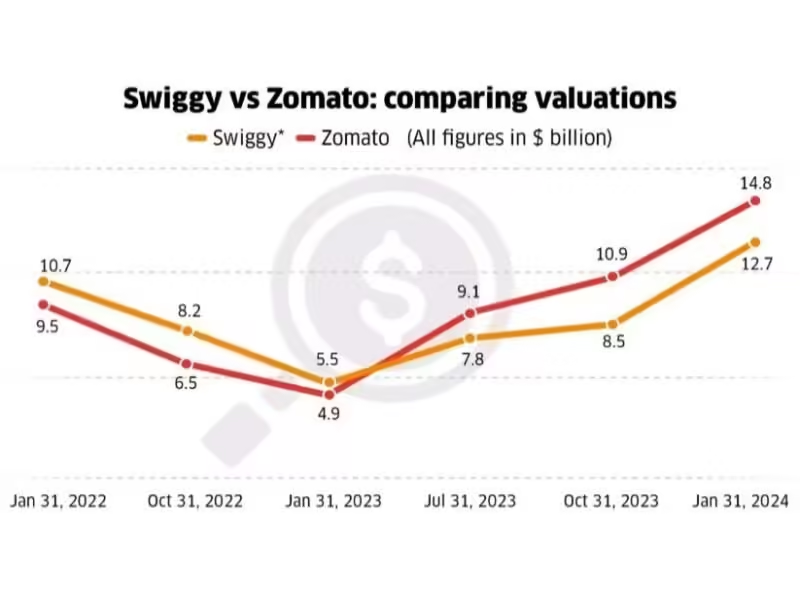

1. Financial Performance Analysis: Swiggy vs Zomato

Benchmarking

- Profit Margins: Zomato’s ability to achieve a profit is rare in the food delivery industry. Globally, most food delivery platforms struggle with profitability due to high costs (delivery, technology, marketing). For example, DoorDash and Uber Eats are also investing heavily, and profitability is a challenge for them too.

- Revenue Growth: Both Swiggy and Zomato have impressive revenue figures of ₹11,247 crore and ₹12,114 crore, respectively. This rapid growth aligns with industry benchmarks as food delivery is one of the fastest-growing markets globally.

Sensitivity Analysis

- Recession: In a recession, consumer spending tends to decline. As people cut back on non-essential purchases, food delivery services might see a drop in orders. Both Swiggy and Zomato could face reduced revenue. Zomato might handle this better due to its current profitability, while Swiggy, already losing money, could face increased pressure.

- Inflation: If inflation increases, the cost of food, fuel (for deliveries), and labor (delivery drivers) will rise. Both companies might need to raise prices, which could hurt customer demand. Swiggy may face more financial strain here since it is already operating at a loss.

2. Customer Satisfaction and Loyalty of Swiggy and Zomato

Net Promoter Score (NPS)

- Zomato has an advantage in terms of user satisfaction, with higher ratings in app stores. Users appreciate its user-friendly interface, wide selection of restaurants, and responsive customer service.

- Swiggy is not far behind, but its slightly lower customer service ratings might reduce its NPS compared to Zomato.

Based on customer feedback, Zomato likely has a higher NPS, showing stronger customer loyalty.

Customer Lifetime Value (CLTV)

Customer Lifetime Value (CLTV) is a measure of how much a customer is worth to the company over time.

- Zomato’s higher monthly transaction users and profitability indicate a higher CLTV. Zomato users might spend more and stay loyal longer, given the company’s focus on quality and service.

- Swiggy, with its higher loss margins, could have a lower CLTV. If Swiggy can reduce customer churn and increase retention through better service, its CLTV could improve.

Loyalty programs like Zomato Gold and Swiggy Super can also boost CLTV by encouraging repeat orders.

3. Competitive Landscape and Market Trends of Swiggy and Zomato

Market Share Analysis

- Zomato appears to have a larger market share based on gross order value (₹32,224 crore compared to Swiggy’s ₹24,700 crore) and monthly transaction users (18.4 million vs. Swiggy’s 12.7 million).

- In regions like tier-1 cities, Zomato might dominate due to its larger restaurant network and better partnerships. However, in tier-2 and tier-3 cities, Swiggy’s presence might be stronger, as it’s focusing on expanding in those areas.

Overall, Zomato seems to hold a larger market share, but Swiggy could perform better in some smaller cities.

PESTLE Analysis

A PESTLE Analysis helps us look at the external factors that impact Swiggy and Zomato.

- Political: Government regulations on labor laws, such as delivery driver wages and benefits, could increase operational costs. Both Swiggy and Zomato will need to manage this.

- Economic: As mentioned in the sensitivity analysis, economic downturns or inflation could lead to higher food prices and reduced customer spending.

- Social: The growing trend of health-conscious eating and organic food could push both companies to offer healthier options.

- Technological: Advances in AI and machine learning can help both companies improve delivery efficiency, reduce costs, and enhance customer experience.

- Legal: Legal changes around data privacy (e.g., India’s Data Protection Law) could require both platforms to tighten their security and data management.

- Environmental: As consumers become more environmentally conscious, both companies are under pressure to adopt sustainable practices like reducing plastic in packaging.

4. Strategic Initiatives and Future Outlook of Swiggy and Zomato

Risk Assessment

Both Swiggy and Zomato face risks associated with their strategic initiatives:

- Expansion Risks: Expanding into new cities or new services like groceries or errand services involves risks, especially if customer demand doesn’t match expectations. Swiggy faces higher risk here, as it’s expanding aggressively while still operating at a loss.

- Technological Innovations: While drone delivery and AI investments promise efficiency, they are costly and may take time to deliver returns. Failure to adopt the right technologies could lead to wasted resources.

- Sustainability Risks: Consumers are increasingly favoring companies that prioritize sustainability. Both companies must manage the costs of eco-friendly packaging and operations without sacrificing profits.

Scenario Planning

Let’s consider three potential scenarios for Swiggy and Zomato’s future:

- Optimistic Scenario:

- Zomato continues to grow profitably, expanding its market share. It successfully implements drone deliveries, reducing delivery times and costs. Its sustainability efforts attract more customers.

- Swiggy reduces its losses and expands into new markets like groceries. Its tech investments pay off, helping it compete more effectively with Zomato.

- Pessimistic Scenario:

- Zomato faces rising operational costs due to stricter government regulations and inflation, which cuts into its profits. Competitors like Amazon Food capture market share.

- Swiggy’s losses continue to grow, and its expansion into grocery delivery faces stiff competition from Dunzo and BigBasket. As a result, Swiggy struggles to maintain profitability.

- Most Likely Scenario:

- Zomato maintains its lead with steady profits and customer growth. Its global expansion continues but at a measured pace. It remains the market leader.

- Swiggy reduces its losses gradually, focusing on technology and customer experience. It becomes a close competitor but still remains behind Zomato in terms of profitability.

5. Conclusion: Swiggy or Zomato Which is Better

Right now, Zomato is clearly leading:

- Profitability: Zomato is the only profitable company, giving it the upper hand financially.

- Market Share: Zomato has more users, higher gross order value, and operates in more cities.

- Customer Loyalty: With a likely higher NPS and CLTV, Zomato retains more loyal customers.

However, Swiggy is a strong challenger:

- Grocery Delivery: Swiggy is branching out into quick commerce (with Instamart), which could open new revenue streams.

- Technological Innovations: Swiggy is investing heavily in AI and drone delivery, which could give it an edge in the long term.

In the long run, Zomato’s solid foundation and profitability make it the current winner. However, if Swiggy can manage its costs and leverage its new services, it could pose a serious threat in the future.